An award-winning Risk Suite

Jan 20, 2020, by Gemma Doswell

Financial Crime Prevention

Payments

Due Diligence

In October 2019, our Risk Suite was awarded the Outstanding New Product Award by the Tackling Economic Crime Awards (TECAs). Our Head of Compliance, Rachel Coote, accepted the award at the ceremony in London.

TECAs is an independent organisation looking to recognise those working towards combatting any area of economic crime. They celebrate outstanding performers, from buyers to suppliers, and base their criteria for recognition on extensive research in the risk management space.

What is the Risk Suite?

The Paybase Risk Suite is our three-pillared financial crime prevention framework. It is made up of our Risk Engine, our Rules Engine and our Onboarding Engine. In today’s technologically-driven landscape, Finextra asserted that “Information is the lifeblood of financial crime investigations.” Our Risk Suite enables our clients to collect and analyse any relevant information about their users, safeguarding them against the increasingly prevalent threat of financial crime in payments. Keep reading to learn more about the state-of-the-art functionality of each engine and how we use them to evaluate risk and to identify and prevent bad actors.

The Risk Engine

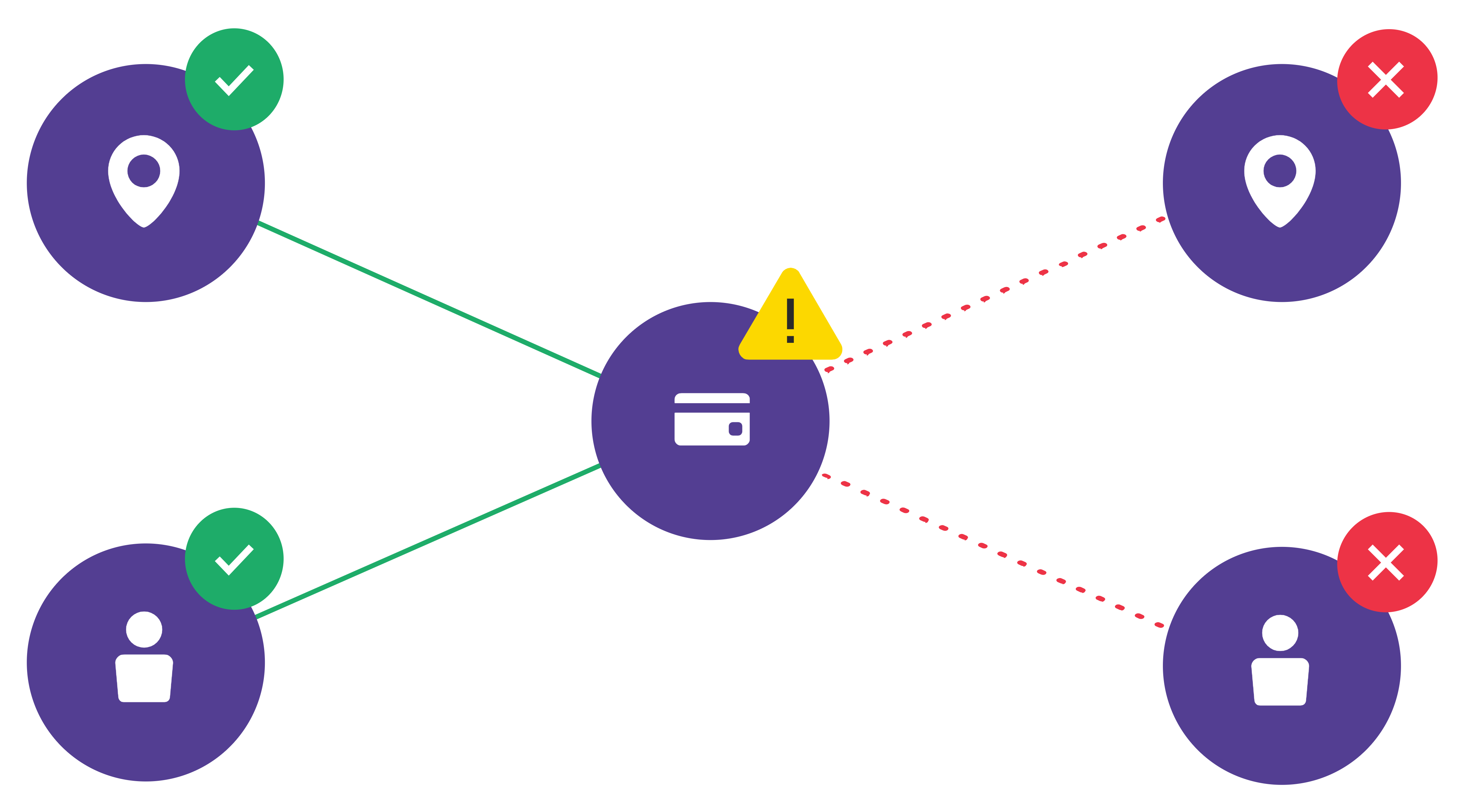

The Risk Engine evaluates the financial risk of each user and transaction that occurs on the Paybase Platform. It uses a real-time scoring system based on unique entities (such as customer names, addresses, cards, bank accounts etc.) to monitor and manage the risk of financial crime. If a customer adds a card and an address associated with this card, for instance, and another customer adds the same card and address information, our Risk Engine generates a risk score based on this information. Factors like geographic risk or IP clusters are also taken into account to calculate the risk score.

Once this data is collected, we can analyse it in a giant interconnected web as in the image above.

The Rules Engine

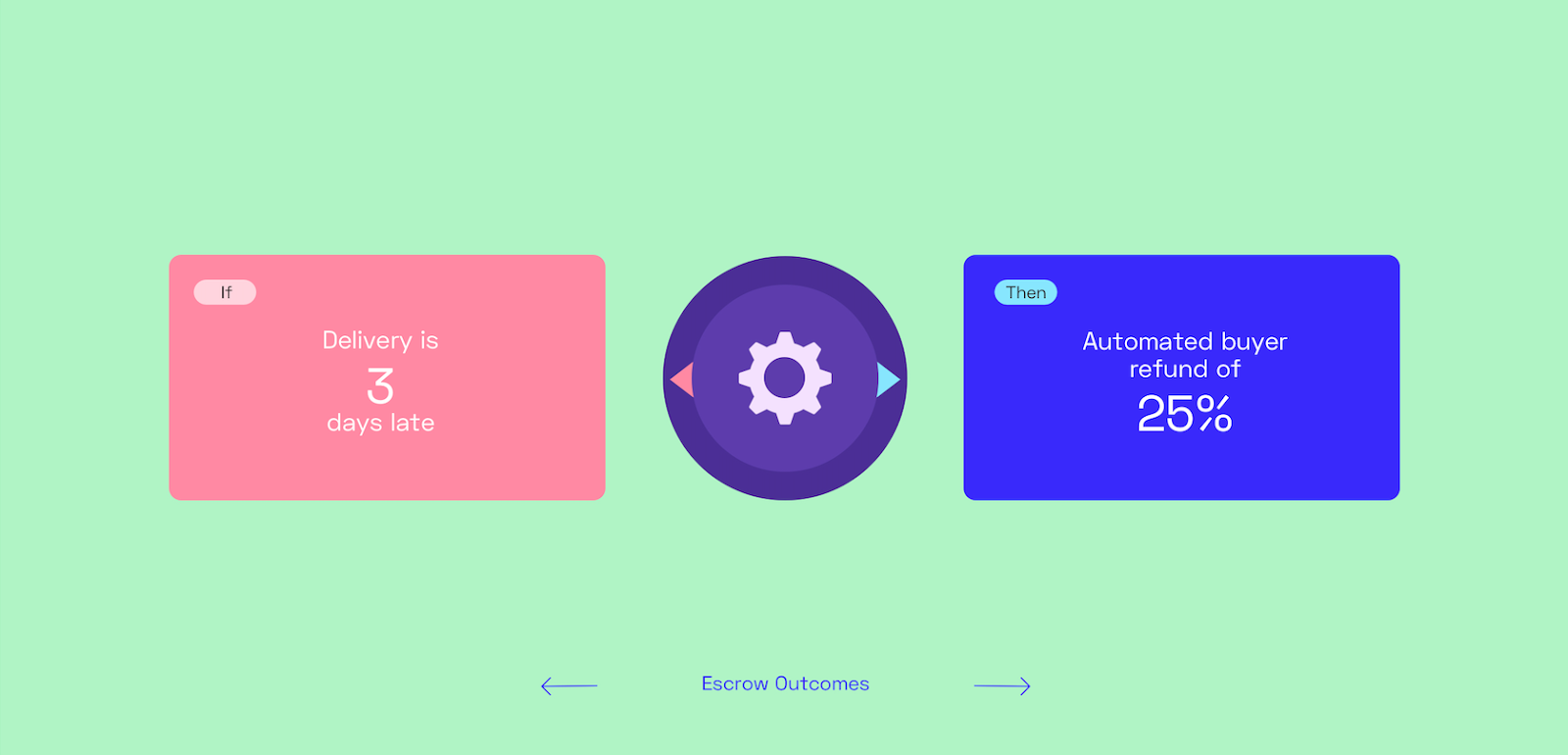

Our Rules Engine is one of our flagship features. It not only gives our clients access to unprecedented levels of flexibility for product enhancement but it furthermore safeguards them with a critical level of security in their transactions.

Built into the Rules Engine are over 100 custom-built rules templates, within which are hundreds of individual rules. They can be instantly configured and combined to serve myriad use cases. For risk management purposes, Rules are used to detect and prevent financial crime. We can configure them to flag unusual spikes in activity, for instance, or automatically block a transaction that is going to a high risk or sanctioned jurisdiction.

Utilised to its full capacity, the scope for the Rules Engine to safeguard a platform business against financial crime is significant.

The Onboarding Engine

The Onboarding Engine is our custom-built Customer Due Diligence (CDD) Processor. Utilising a tiered framework, we request user information based on the level of risk associated with each user - and this can be done on a client-by-client basis.

If a platform, for instance, needs to perform a particularly high level of CDD on a group of their users but a more measured level of CDD on the rest of the users, we can request X from one user type and Y from another. Furthermore, with real-time transaction monitoring, we can automatically request additional information from merchants or users as the amount of money that they are operating with (and therefore their level of risk) increases.

This enables our clients to perform strong Due Diligence on their users without ever negatively impacting UX.

Want to know more about how we could help you secure your transactions? Get in touch here!