Key Challenges with Building a Payments App

Jun 7, 2017, by

Payments

Regulation

Startup

As any young startup, we were eager to get-to-market as quickly as possible.

Little did we know that building the payments component of the Payfriendz App - modest P2P functionality - would take much longer than expected and significantly delay our launch date.

We searched high and low for a secure, modern, tech-first payments partner that could deliver payment solutions and handle compliance and risk, but were shocked to find none existed and instead we had to shoe horn our product into working with a string of legacy providers.

Setting up electronic Money (eMoney) infrastructure in order to power our app was a massive undertaking due to the complexity of the process, all the moving parts involved and the necessity to gain regulatory cover and manage risk.

The Paybase Platform is our response to the inordinate challenge in our Payfriendz journey. It addresses and resolves all the pain points we experienced building a P2P app as well as the pain points any app/product requiring eMoney solutions has to face. The Platform is perfect for Marketplaces (such as Crowdfunding sites, Gig/Sharing Economy platforms) and FinTech products and is meant to spare other young and innovative companies the arduous journey that we have been through.

Now we want to share this journey and our key struggles with you.

#1 Key challenge: Regulatory cover

In order to be able to issue eMoney, you have to get licensed as an eMoney Institution (EMI) by the FCA (Financial Conduct Authority) or be appointed as an Agent by another EMI.

It can take up to six months to prepare the application - depending on the size of your company, your business model and how thorough you want to be - and up to another six months to get approved.

In the current market, this is a lifetime. A lifetime spent on gaining regulatory cover rather than on your core business.

But it doesn’t stop there. If you want to issue not only eMoney but also physical or virtual pre-paid payment cards you either need to get an issuing license for Visa or Mastercard (high cost, long time frame!), or find a BIN Sponsor who will allow you to operate under their license.

However, finding a BIN Sponsor who will support you is not 100% straightforward. A BIN Sponsor will only grant you the cover you need once you have proven that your organisation has the experience needed to operate a financial product and manage all the intricacies around fraud and risk management, operational flows, etc. If you don’t have this expertise already, you will need to look at hiring a person or assembling a team that does.

#2 Key Challenge: Risk management and fraud prevention

Although we could make educated predictions about how Payfriendz App would be used, it is impossible to completely predict how your customers will use your product.

You can plan and test for many eventualities, but you never completely understand ‘typical user behaviour’ until you have an active user base.

We had to spend a lot of time going down the trial and error route until eventually we started seeing patterns and finding ways of best preventing misuse of the app.

The legacy partners we engaged with offered transaction monitoring tools and services, but they were not flexible enough to support our use case so we designed a built our own tools in house.

This meant further distractions from our core product offering in terms of time, resource and money.

#3 Key Challenge: Risk, KYC, and Identity Verification Providers

Risk, KYC (Know Your Customer), and Identity Verification providers help businesses verify clients’ identities ensuring anti-money laundering regulatory requirements are upheld.

Unfortunately, choosing the right KYC provider for your business can be a challenge. The KYC provider we worked with originally led to really low pass rates (at one point as low as 40%), as our student customer base had minimal credit history due to their age.

After extensive research and trials of different providers we came to understand the KYC provider market well and understood that we needed a provider that was well placed to verify younger customers, by, for instance, leveraging social graphs.

Extensive expertise in the payments industry is required in order to get these things right the first time, which is critical when your business depends on payments.

#4 Key Challenge: Integration with partners

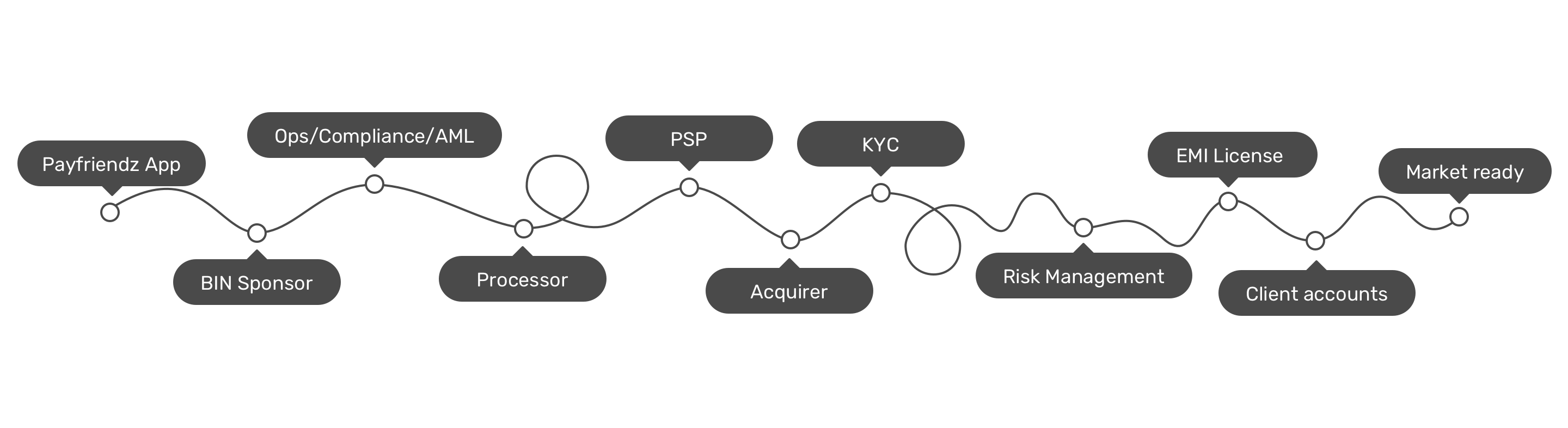

As the Paybase Platform was not available when we started out with the Payfriendz App, we had to integrate with many different partners in order to meet our requirements. These included a BIN Sponsor, Transaction Processor, KYC Provider, PSP, Acquirer and Banking Partner.

As you can imagine, managing many integrations with third party providers at the same time is extremely time consuming. Not only did we have to project-manage all integrations, but we also had to account for dependencies (e.g. not all BIN sponsors and Processors can work together out of the box) and naturally each integration needed thorough testing.

“When developing Payfriendz, managing integrations across multiple partners was a cumbersome task. In many cases, we were we forced to deal with outdated technologies such as SOAP and XML, requiring us to manage WSDL imports and updates which often contained errors. Coupling this with API documentation which was out of date, or even completely incorrect, fostered a development environment which was often incredibly frustrating to work in.”

- Joel Pickup, Software Engineer

And even post-launch, our app had occasional issues.

Our launch marketing push meant huge user base growth and a sudden increase in required capacity which some of our partners struggled with.

Unfortunately, there were times when the app was down for up to 24 hours whilst issues were being sorted out. Understandably customers were complaining and as the issues were external, there was nothing we could do ourselves. For us as a team this was highly frustrating, having worked so hard to make sure the setup was perfect before launch.

Managing multiple integrations with multiple partners who have different SLAs that use legacy technology requires both time and patience and seldom leads to the user experience that we would have liked to provide our customers with.

#5 Key Challenge: Contract length and costs

Most of the above partners have high setup fees, monthly minimums commitments and long contract terms which is anything but startup- and innovation-friendly.

And the high fees do not include changes in scope and requirements - something that legacy partners struggle to provide within reasonable time.

Some of our requirements for the Payfriendz App were not supported ‘out of the box’ which meant we had to pay extra and wait for weeks, sometimes even months for these changes to go live.

In summary, throughout the process of developing a simple P2P payments app, it became very apparent that partners are still set up to support the old fashioned financial world, but not the new innovative FinTech companies that are emerging.

The Paybase Platform is changing this.

The Paybase Platform offers a simple, yet flexible, single integration covering payments, compliance, and risk. There are no prohibitive set-up fees, enabling innovation from small and mid-size companies that would normally struggle to afford such infrastructure.

We spare you multiple integrations with many payments partners, take care of regulatory requirements and provide you with state-of-the-art risk management tools. With no internal process overhauls and one touch point, we can get you to market faster.

We support a myriad of eMoney use cases straight out-of-the-box and can easily adapt to any changes in your requirements today or later down the line.

“Our mission is to democratise access to payments infrastructure by removing the prohibitive cost and knowledge barriers so that our partners can focus on their core business.“

- Anna Tsyupko, CEO

What are you working on?

We would love to discuss how we can solve your payments, compliance and risk requirements. Get in touch