The Sharing Economy: When Will Payments Catch-Up?

Jun 22, 2017, by Dan Whale

Sharing Economy

Payments

Challenges

The sharing economy is skyrocketing in a way which is transforming how we live our lives, yet its payment aspect remains stuck on the ground.

The emergence of the sharing economy has been difficult to ignore. Online marketplaces such as Etsy, Depop and Gumtree have become ever-more popular, especially amongst millennials, but this presence goes far further than simply online shopping. Uber has globally revolutionised hailing taxis and AirBnB has swiftly become one of the most favoured forms of booking holiday accommodation.

With retail, travel and holidays being suitably disrupted, other industries are entering the space. Sites like TaskRabbit allow you to offload your DIY jobs to a willing helper, and everyone from graphic designers to dog sitters can now be found in a similar way to your next holiday.

So why is this form of trading so successful? Put simply, it removes the middleman between merchant and consumer, benefiting them both. Merchants are able to sell their product/service more easily and consumers have access to a larger, more diverse market. This gives the consumer the most powerful gift - choice.

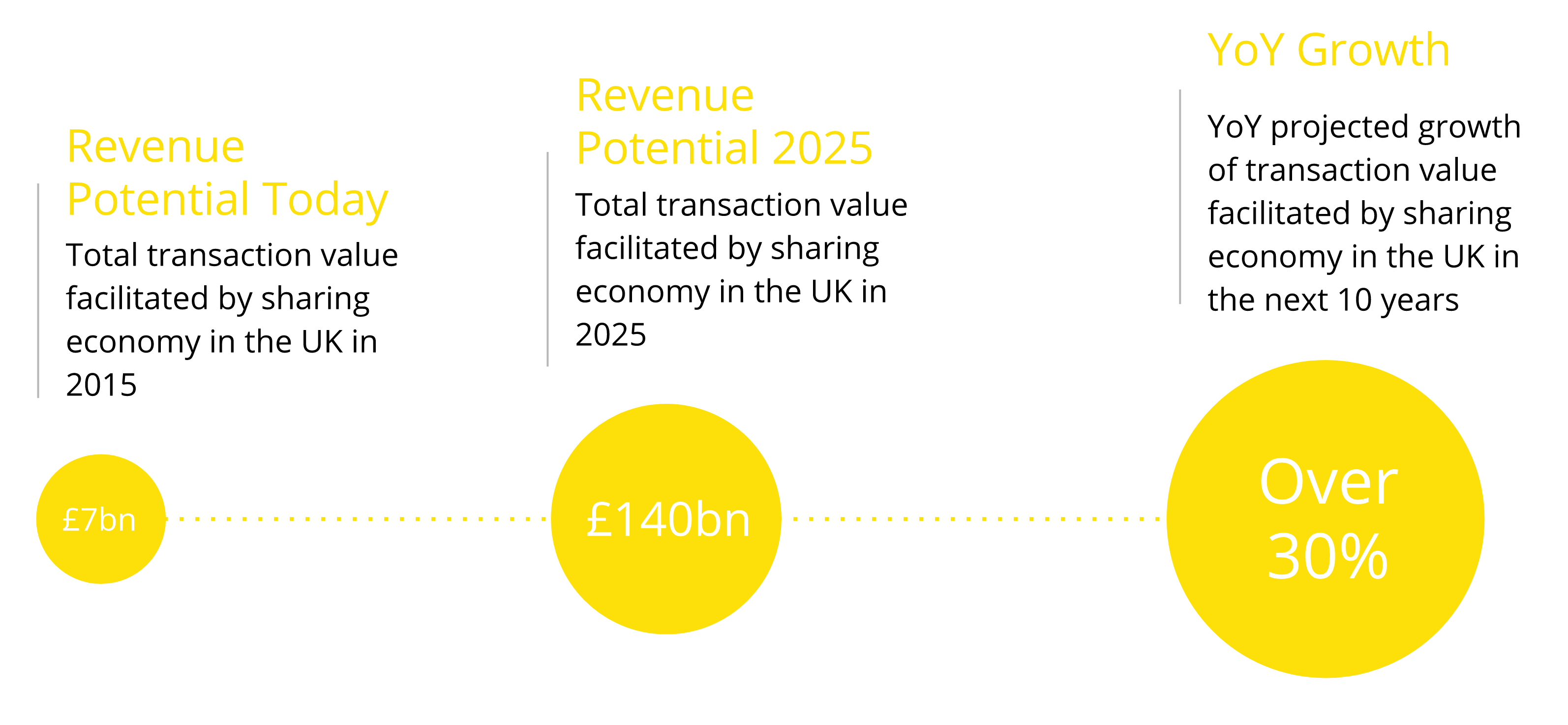

Growth in the Sharing Economy. Source

Growth in the Sharing Economy. Source

So what is holding the sharing economy back?

Whilst the growth of the sharing economy cannot be ignored, this is not to say there are no challenges facing platforms facilitating the sharing economy. The processing of payments still remains a massive challenge to online marketplaces.

Entrepreneurs will often divert the majority of their time and resource to the development of the marketplace app or website, and underestimate the difficulty involved in the getting the payments component right.

Due to the antiquated nature of payment processing, marketplaces are presented with four options for their payments requirements.

Option 1: The easy option

Firstly, they can avoid the hornet’s nest altogether and create a platform that does not support payments, as Gumtree does. This discourages consumers who are unable or not willing to travel to collect items and also limits what is likely to be bought on the site. Many people will not want to go to a carpark at 11pm to pick up a laptop, for example. Gumtree even offer safety tips on buying and their number 1 FAQ is ‘How to spot fake bank notes’ - not a great way to instill confidence in a purchase and give a feeling of security.

Option 2: The PSP/Acquirer hassle

Secondly, marketplaces can decide to take payments by partnering with a PSP/Acquirer. This requires both knowledge and experience with accounting to provide the manual reconciliation to their sellers. As a marketplace grows, ensuring all sellers receive their profit in a reasonable timeframe can require large amounts of work and become costly.

Option 3: The UX faux pas

The option of partnering with PayPal normally involves leaving their platform to make a payment. Statistics show that 69% of all online transactions are abandoned, and as such businesses are starting to focus on how to improve their conversion rate1. Handling payments this way can be seen as the ultimate UX faux pas.

Option 4: The DIY way

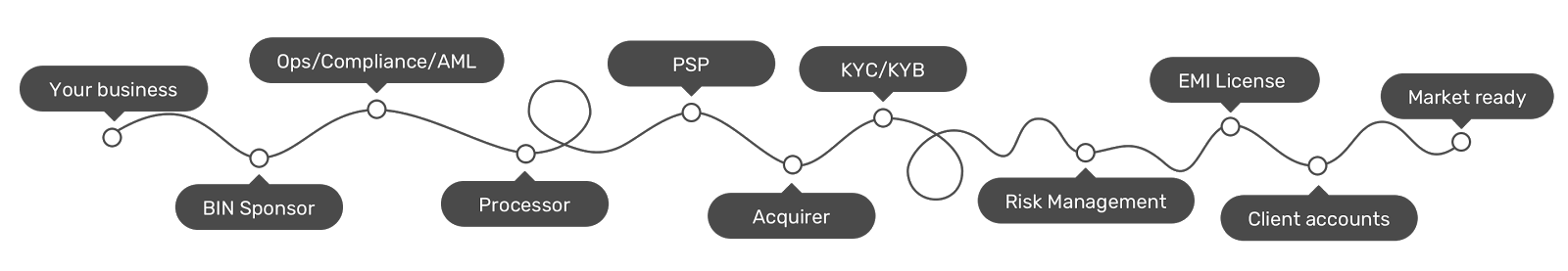

Finally, if a marketplace realises that the first three options are poor they may seek to create their own eMoney infrastructure (see what is involved below) as Airbnb did.

It’s a solid way to go, if you can afford to pay many in-house experts and spend months putting all integrations in place, waiting for your EMI licence to be granted and to building up your internal Risk and Compliance team. Depop will tell you that setting up your own eMoney system is not easy. They created the Depop Wallet in November 2015 and halted any new accounts a year later due to safety concerns.

Never fear, there IS another option…

Option 5: Power your marketplace with Paybase

A much faster, simpler, more secure and UX friendly solution to meet the needs of the rapidly growing sharing economy is eMoney infrastructure that can be integrated through one unified API.

This is where Paybase delivers!

We are centered around supporting and driving innovation to aid this growth by facilitating payment processing for marketplaces.

So how can the Paybase Platform make things easier?

Paybase offers easy to create, segregated eMoney accounts that allow merchants to be paid directly and securely. This eliminates the need for reconciliation yet allows the marketplace to retain total control of the money, easily taking their percentage for use of their platform.

With our proprietary Rules Engine, the marketplace can define logic for every transaction to determine a set fee or percentage to be taken from that transaction.

Our solution will not take consumers away from the marketplace to complete their purchase, helping to reduce the 69% abandonment rate. Not only this, but it will run entirely in the background, allowing the payments element to be branded identically to all other parts of the platform. Simple, effective, beautiful UX.

In short, we allow marketplaces to concentrate on growing their core business by making payments simple for merchants, consumers and the marketplaces themselves.

Paybase loves innovation and we’re excited to see which industry will be re-energised next by the sharing economy. However, by leaving payments as an afterthought companies entering the sharing economy may find themselves in far more difficulty than they need to be.

If you like what you read and are interested to find out how we can help you with your payments, compliance and risk requirements - get in touch. We’d love to hear from you.

Follow us Twitter LinkedIn Google+

References

1